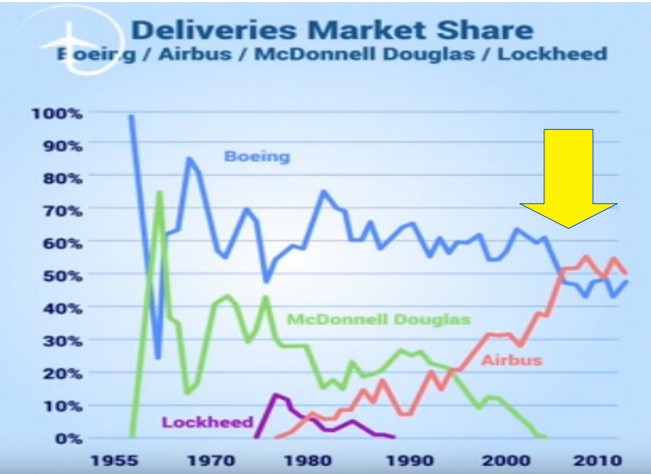

Until Airbus started in the 1980s, Boeing enjoyed a virtual monopoly. However, due to a series of blunders by Boeing upper management, even before the competition from Airbus, Boeing employees and the economy of Washington state was subjected to a very rocky ride.

Boeing commercial airplanes began with the success of the 707 which was built from 1957 to 1979. The plane had four jet engines under the wings. This was followed by the 727, which was built from 1964 to 1984 and had three engines all at the tail of the plane. In 1957, employment at Boeing topped 100,000 for the first time, with most employees working at either the Seattle or Renton factories.

In the 1960s, Boeing decided that Jumbo Jets were the future. Boeing bought Paine Field in south Everett to build the 747. The workforce at Everett soon exceeded 20,000. In 1968, employment at Boeing reached 142,000 with as many as 100,000 additional people working for local Boeing sub-contractors.

1969 to 1979 The Boeing Bust

The first 747 rolled out of the world’s largest building near Paine Field in 1969. Unfortunately, in the 1960’s, Boeing executives bet the farm that Super Sonic Transports were also the wave of the future. They spent a fortune developing an SST called the Boeing 2707. Unfortunately, the SST caused a sonic boom on takeoff. The SST was feared to damage the Ozone Layer which protects the earth. Congress therefore suddenly stopped funding the 2707 in May 1971 and the SST was banned in the US. At the same time, there was a downturn in the commercial aviation market. Boeing laid off more than 25,000 workers in 1969 and another 41,000 in 1970. Then in 1971 came devastating news. When Congress cut funding for the SST, Boeing cut 20,000 more jobs. The workforce hit a low of 56,300. This Boeing Bust had put 86,000 workers on the street in three years. In April 1971, someone placed a huge billboard near Interstate 5, with the grim request, 'Will the last person leaving Seattle turn out the lights.”

1980 to 1990 Airbus offers a better plane with bigger engines

By 1980, Boeing's employment rebounding back to more than 100,000 thanks in part to orders for the 737 Classic . Then Airbus came out with the A320 twin engine single isle airplane to directly compete with the 737 Classic. The advantage of Airbus was that they had the wisdom to understand that new more fuel efficient engines would be bigger than the older gas guzzlers used by Being. Airbus therefore created a better design with more room under the wing for these new more fuel efficient engines. Since 1987, Airbus has sold 8,000 A320s.

As a direct result of competition from Airbus, and their bigger more fuel efficient engines, in 1992 Boeing announced another layoff of 28,000 workers. As the trend toward bigger more fuel efficient engines was obvious as far back as 1970, Boeing must have realized the design flaw of the 737 and the lack of engine space back in 1980. After all, they had been forced to alter the 737 Classic engines into an extreme hamster shape in the 737-300 which was announced in 1981 and certified in 1984 . But the problem was that management was not willing to reduce short term profits in order to do a complete redesign of the 737. They therefore kicked the can down the road in the the 1980s and they continued to kick the Wing problem can down the road in the 1990s. This is why they were losing market share to Airbus.

1990 to 2000 A Culture of Corruption

In the 1990’s, it became obvious that the bigger and more efficient Airbus engines would drive Boeing out of business. Boeing then began to design a more fuel efficient version of the 737 called the 737- Next Generation or 737 – NG for short. The first 737-700-NG was flown on July 31, 1997 and certified by the FAA in 1998. However, once again, Boeing failed to recognize that the trend to bigger engines would continue. Instead, Boeing once again kicked the engine can down the road in order to keep their profit margins as high as possible. The engines for the 737 NG were still shaped like hamster cheeks and were only one inch bigger than the prior 737 Classic engines. Boeing had obviously come to the end of the line in terms of how big of an engine they could fit under the wing of the 737 without a complete redesign.

In 1997, Boeing merged with one of its chief competitors in the defense field, McDonnell Douglas. Many articles and even books have been written about how the Culture of Corruption at McDonnell Douglas was transferred to Boeing as a result of this merger. However, I think the failure of Boeing to redesign the 737 in the 1980s or 1990s to make more room under the wing for larger engines is evidence that Boeing already had its own Culture of Corruption.

Boeing Workers Pay a Heavy Price

As just one example of the Boeing Culture of Corruption, Boeing has refused to accept responsibility for illnesses caused by the chemicals in its plants. Boeing employed scientists to question or deny physical maladies and to even deny the existence of diseases like Multiple Chemical Sensitivity, which causes a breakdown of the immune system from continual inhalation or contact with certain chemicals Boeing uses. Boeing also used its influence in the Washington Department of Labor and Industries (L&I) to deny the existence of any such aliment. One estimate of Boeing’s potential liability in these claims was $450 million. Details of Boeing’s record of refusal to acknowledge injuries to its workers is documented in: Eric Nelson and Mark Worth , “Boeing to ill workers: ‘It’s all in your head’”: Washington Free Press, Feb/March 1994 www.washingtonfreepress.org.

Boeing Launches Corporate Crime Wave

Instead of sticking to “legal’ forms of robbing money from the public purse, such as military contracts, Boeing has employed Enron-like accounting and has broken the law many times in its insatiable drive for increased profits at all cost.

In 1994, Boeing paid $75 million to the federal government to avoid criminal prosecution of overcharges on the KC-125 tanker. Business Week did a three-month investigation of Boeing’s questionable accounting practices during the lead-up to its 1997 merger and takeover of rival McDonnell Douglas. Business Week found that Boeing artificially inflated its earnings for two quarters in 1997 by $2.6 billion dollars, thus hiding the fact that production costs were running much higher than was disclosed to investors. Business Week wrote: “Boeing did more than simply fail to tell investors about its production disaster. It also engaged in a wider variety of aggressive accounting techniques that papered over the mess.”

In a deal approved by a US. District Judge, Boeing settled a private securities-fraud suit over the 1997 episode for $92.5 million, rather than let it go to court.(See Stanley Holmes and Mike France, “Boeing’s Secret- Did the aircraft giant exploit accounting rules to conceal a huge factory snafu”: Business Week, 5/20/02).

Since 1995, Boeing has agreed to pay $1.5 billion to settle 70 instances of misconduct, including $615 million in 2006 in relation to illegal hiring of government officials and improper use of proprietary information.

https://www.contractormisconduct.org/

https://www.contractormisconduct.org/misconduct/300

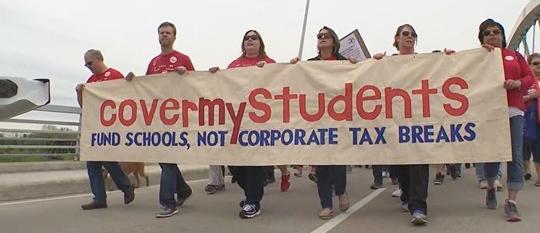

In 1997, Boeing and other major corporations and billionaires succeeded in getting one of the largest tax breaks in Washington state history passed by the Washington state legislature – the commercial intangible property tax exemption. This tax exemption has cost Washington state more than one billion dollars per year – causing Washington state to drop from 11th in the nation in school funding down to 47th in the nation – and forcing Washington states one million school children to endure the highest class sizes in the nation. In November 2000, the Voters of Washington state responded by passing Initiative 728 – the Class Size Initiative – by a margin of nearly 2 to 1. But thanks to Boeing tax breaks, it has never been funded.

2000 to 2010 From Tax Dodging to Blackmail

In May 2001, even though the airplanes were still being made in Seattle, Everett and Renton, Boeing executives moved their corporate headquarters from Seattle to Chicago. Little has been written about why this move occurred. But likely reasons included tax evasion. Boeing already had been evading paying the Washington state sales tax by literally flying new planes out of Washington state and signing sales contracts over the Pacific ocean. Boeing also had been using similar methods to avoid paying the Washington State one percent Business and Occupation tax.

Boeing evaded Washington state 5% sales tax and 1% Business tax by claiming that the sale was made "overseas,"- i.e. not in Washington. A Boeing flight crew flew a new plane from Seattle to just past the 200-mile limit of US. sovereignty off the Washington coast, at which time money is transferred by wire and a new crew flew the plane back to Seattle, completing the sale. Had Boeing been required to pay the sales tax on the sale of its airplanes – like any other business in Washington State – it would have paid at least 5% to 6% of an estimated $40 billion in annual sales. This is more than $2 billion per year in Boeing state tax evasion. This illegal tax dodge is still going on.

(Source: Exemptions to Washington state business taxes: “Tax Exemptions 2000, 2004 and 2008”, published by Washington State Department of Revenue. Boeing’s exemption to sales tax on the sale of airplanes documented in George Erb, "Biz fears state may roll back some tax breaks", Puget Sound Business Journal, 12/0/2001.

Boeing’s tax-evasion trick of selling planes 200 miles offshore is documented in: Robert Cringely, "Through a Loophole, Darkly": I, Cringely, archived column, PBS, 10/8/98, www.pbs.org/cringely/pulpit/pulpit19981008.html

A sharp downturn in air-passenger traffic occurred following the September 11, 2001, terrorist attacks, which resulted in fewer airplane orders. Boeing responded on Sept. 19 2001 with a massive layoff. Boeing laid off nearly 30,000 people and its Washington workforce dropped to around 54,000.

2003 Boeing Replaces Tax Evasion with Outright Blackmail

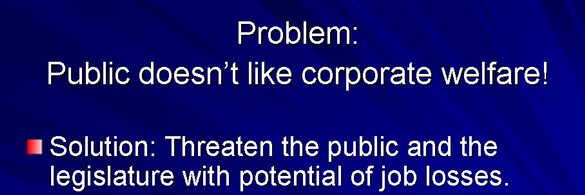

In 2003, Boeing used the threat of outsourcing jobs to blackmail our legislature into giving them 3 billion in additional tax breaks. The legislature caved…and Boeing still outsourced thousands of the jobs anyway. Those tax breaks were supposedly to “save jobs.” But that same year Boeing announced another thousand layoffs. So Washington state lost the money and the jobs. Nor was the tax break needed to make Boeing profitable as Boeing had been making over $3 billion a year for the preceding several years. A Boeing Lobbyist called it turning our State legislature into a “Cash Cow.”

Boeing union workers have referred to this outsourcing as the “Disappearing Boeing Airplane” because outsourcing of high paying jobs has been going on for many years. Many legislators privately refer to it as Corporate Welfare. In reality, it was nothing more than blackmail.

The $3.2 billion in tax cuts for Boeing, provided with House Bill 2294 passed on June 11, 2003, was achieved by gutting funding for Washington states public schools that very same week (see House Bill 1449 which cut hundreds of millions of dollars per year in school funding in order to give Boeing hundreds of millions of dollars per year in tax breaks). The Washington state Governor and Legislature, many of whom had been given contributions by Boeing to win their election to office, repaid their corporate benefactors by giving Boeing an additional $3.2 billion tax exemption deal. This was ten times greater than any other State had offered Boeing. Here is another slide from the Boeing lobbyist 2004 slide show:

The 2003-2005 budget approved by the State Legislature cut $600 million for the Biennium from K-12 public education and reduced public higher education by $131 million. By gutting school funding, the legislature was cutting the jobs of about 2,000 teachers even as Boeing was cutting the jobs of more than 1000 workers.

According to an article published in the Seattle Weekly on December 24, 2003, called Billions for Boeing, the State also committed to $4.2 billion in transportation improvements around the Boeing Renton and Everett plants. Therefore, the total 2003 Boeing Tax Break package was $7.5 billion on top of the $2 billion per year they were already getting by evading the Washington state sales tax, Business and Occupation tax and evading the commercial property taxes. One union leader, interviewed after the 2003 tax breaks passed, referred to it as "the day corporate greed won."

Thanks to more than $3 billion per year in state tax evasion, Boeing was doing extremely well. Boeing’s combined commercial and military operations had sales of over $50 billion per year. Average profits were about $3 billion per year – due almost entirely to tax evasion. http://boeing.mediaroom.com/index.php?item=1043&s=43

For a more detailed list on the tax breaks given to Boeing, see also: http://www.wisconsinsfuture.org/publications_pdfs/otherpubs/BOEING%20REPORT4_web.pdf

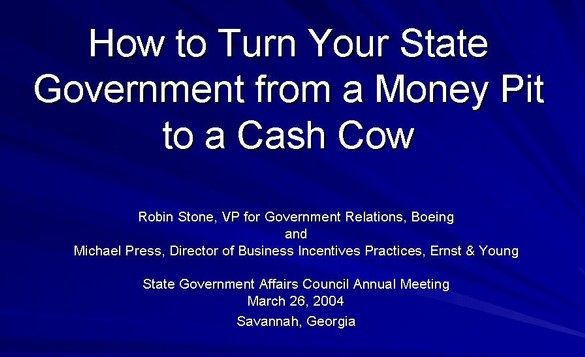

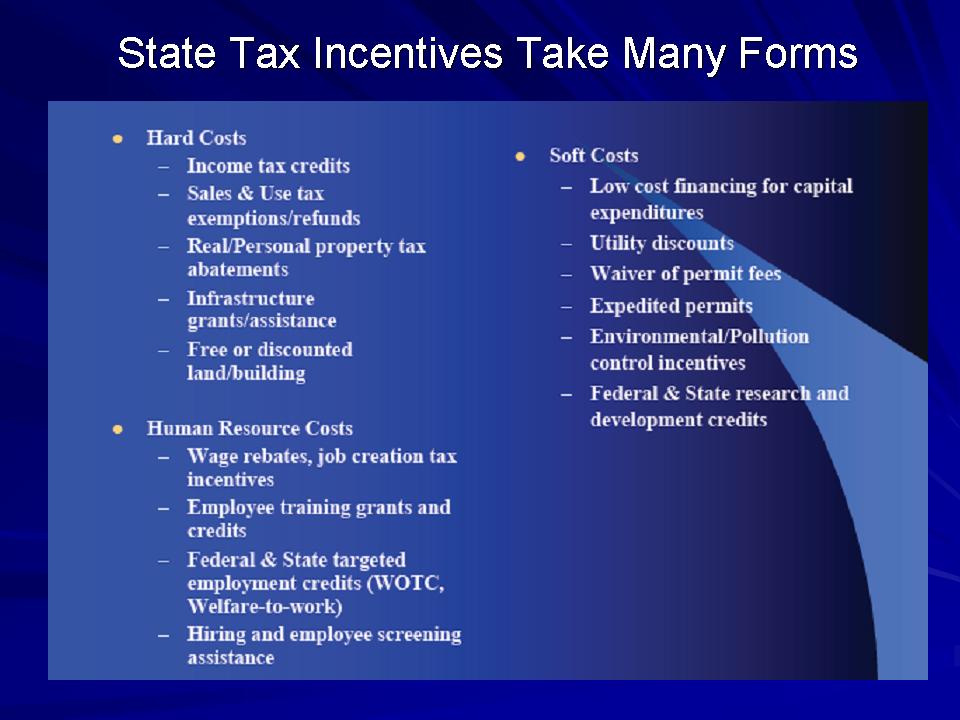

In March 2004, Boeing lobbyists, fresh from their victory in Washington State, took their show on the road to a National Corporate Lobbyists Convention in Georgia. Here they put on a Power point Presentation explaining how other corporations could also evade paying State and federal taxes by blackmailing the public with the threat of job losses.

The Incentives were broken down into three categories: Hard Costs, Soft Costs (Hidden costs) and Human Resource Costs. It includes 27 different methods for getting tax breaks and Boeing has used all 27 methods listed above. Using this multiple forms of tax breaks strategy makes it almost impossible to determine the true cost to the public of all the Boeing corporate tax breaks. Boeing lobbyists actually boasted about how successful they were in manipulating the public and the legislature with threats of out sourcing jobs.

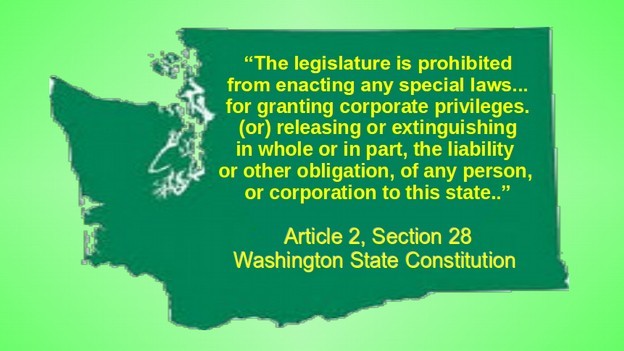

Why Boeing State Tax Breaks Are a Violation of the Washington State Constitution and are still owed to Washington State

Boeing forced the Washington legislature to give them tax breaks of over three billion dollars per year since 2003 – more than $45 billion as of 2019. Nearly all of these tax breaks were paid for by robbing Washington state schools of funding – leading to students in Washington state to be forced to endure the highest class sizes in the nation since 2003. These Boeing tax breaks have always been a violation of the Washington state constitution. The state legislature violated the State Constitution in granting these tax breaks. Moreover the Washington State Supreme Court has ruled that State taxes owed have no Statute of Limitations – meaning that Boeing currently owes more than $45 billion in back taxes to the tax payers and public school students here in Washington state.

Here are the relevant provisions in the Washington state constitution. There are several major differences between the Washington State Constitution and most other state constitutions. Here are three of the most important differences as they apply to the State legislature diverting funds away from our public schools and into the pockets of Boeing.

#1 A clause making the ample funding of schools the paramount duty of the state (rather than making the adequate funding of schools one of the duties of the legislature). Unlike other states, which made it the duty of the legislature to adequately fund our schools, the drafters of our State Constitution created a shared Paramount Duty - a duty applied to the entire State Government including the Supreme Court - when they wrote Article 9, Section 1: "It is the paramount duty of the state to make ample provision for the education of all children residing within its borders, without distinction or preference on account of race, color, caste, or sex.".

The Washington State Constitution is the only constitution in the nation to make it the Paramount Duty of the State to amply fund public schools. Thus, the drafters of our state constitution had one paramount goal, namely the ample funding of public schools. In order to achieve that paramount goal, they did everything they could think of to minimize the chances that powerful corporations like Boeing might corrupt and take over our state legislature.

#2 A clause requiring a uniform system of state taxes.

Article 7, Section 1 of our state constitution states: "The power of taxation shall never be suspended, surrendered or contracted away. All taxes shall be uniform upon the same class of property within the territorial limits of the authority levying the tax and shall be levied and collected for public purposes only. The word "property" as used herein shall mean and include everything, whether tangible or intangible, subject to ownership." Put another way, even if the legislature had fully complied with their Paramount Duty to amply fund our public schools, tax breaks to wealthy corporations would still be against the Washington State Constitution.

#3 Several clauses prohibiting the legislature from granting tax breaks to private corporations. Throughout the State Constitution, there are several clauses that indicate that granting tax breaks to private corporations is unconstitutional. Here are just a few of those clauses.

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws…

Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Article 2, SECTION 30 BRIBERY OR CORRUPT SOLICITATIONstates:

"The offense of corrupt solicitation of members of the legislature, or of public officers of the state or any municipal division thereof, and any occupation or practice of solicitation of such members or officers to influence their official action, shall be defined by law, and shall be punished by fine and imprisonment."

Corporate lobbyists now control Olympia by offering bribes, called campaign contributions, to any legislator willing to pass laws to give their corporate masters special tax breaks. These bribes/ campaign contributions are all unconstitutional and the corporate lobbyists who are giving these bribes should all be put in jail.

Even after our Supreme Court ruled in 2012 that our public schools were not being amply funded (something obvious to any parent or teacher), the legislature continued to enact even more tax breaks - including a new $9 billion tax break for Boeing that was the largest tax break in the history of the planet.

Billions in federal tax breaks for Boeing

Boeing received corporate welfare not only at the state level but at the federal level. Boeing’s other source of public money is its deep engagement with the US. Department of Defense. Boeing’s defense-related activities are totally dependent on our tax-dollars. Its research and development costs related to new technologies for improved military aircraft and spacecraft design are fully paid for by the US government. These innovations are a public gift to Boeing, which are then used in their commercial airline development.

As for federal tax breaks, in 2008, Boeing made $3.8 billion in profit, but only paid federal taxes of $44 million – an effective tax rate of less than 1%. In 2009, Boeing suffered huge losses due to bungled 787 outsourcing. But it still made a profit of $1.6 billion on which it paid NO TAXES AT ALL.

Instead Boeing received a payment from the federal government of $132 million. Thus combining the 2008 and 2009 tax years, Boeing made $5.4 billion dollars in corporate profits on which they paid NO FEDERAL TAXES! In addition, between 1992 to 2004, Boeing received more than $12 billion in direct federal subsidies (about one billion dollars per year) for research grants. Boeing is consistently number one or two on the list of Top US Federal Contracts receiving more than $20 billion per year.

https://en.wikipedia.org/wiki/Top_100_Contractors_of_the_U.S._federal_government

2005 Boeing 787 Scandal… Even the Outsourcing was Outsourced

In 2004, despite the 2003 tax breaks, the Boeing workforce was once again at low ebb -- about a hundred thousand Boeing jobs had vanished in the Puget Sound area since 9/11, for total employment of 52,000 in Washington. The consequences of the decision by Boeing’s upper management to bleed our State dry – and rob our children of their future - in the pursuit of short term greed should serve as a case study in why it is never good to give in to black mailers. It is proof that tax exemptions to wealthy corporations do not create jobs – they only cost jobs.

The Boeing 2003 tax deal was intended to protect the 787 Plant in Everett – which was claimed it would create 3,600 jobs. But in fact, there was no requirement that Boeing keep even a single job in Washington State in trade for getting billions in tax exemptions.

The December 2003 Seattle Weekly article noted that Boeing just two months earlier had laid off more than one thousand of workers – 800 from the Commercial Airplanes Division in October, 340 more in November and 165 more in December – for total layoffs during Fall, 2003 of 1,306 workers. All of these jobs were outsourced to other States and countries with cheaper non-union labor. The Seattle Times later reported that in fact only 200 jobs were created – a cost of more than $10 million per job. “Huge Tax Break for Boeing did not deliver many new jobs,” Seattle Times Dec 17, 2007

Instead, Boeing used the billions in tax breaks they had gotten from the corrupt Washington state legislature to build a competing 787 plant in South Carolina. The South Carolina plant cost more than one billion dollars to build. It was paid for almost entirely with tax breaks given to Boeing by Washington state. Delays and errors associated with Boeing’s failed 787 outsourcing strategy have been estimated to cost more than $20 billion.

Boeing Outsourcing cost $20 billion

Despite paying almost no State or federal taxes, what has harmed Boeing’s profit margins the most in recent years has been staggering losses resulting from their misguided outsourcing strategy. Problems with outsourcing have cost Boeing billions of dollars and led to a 2 year delay in production of their 787 Commercial airplane. On September 6, 2009, the New York Times reported on the financial impact of Boeing’s outsourcing problems. See http://www.nytimes.com/2009/09/06/business/06boeing.html?pagewanted=1&_r=1

The article stated: “Boeing acknowledges that the problems have sorely tested the patience of suppliers and customers, and damaged its credibility. Already, 60 orders have been canceled, partly because of the delay. “

At an average sales price of $125 million per airplane, the total value of these 60 cancellations have been $7.5 BILLION in lost sales.

“Stock analysts estimate that the company initially planned to invest $8 billion to $10 billion in developing the project, but could end up spending $20 billion, including the penalties it will owe for delivery delays.”

Thus, penalties and delays resulting from outsourcing increased the development cost by $10 BILLION.

“On Aug. 27, 2009, when it announced the new flight test and delivery schedule for the Dreamliner, Boeing also said it would take a $2.5 billion charge, or $2.21 a share, in the third quarter to write off the cost of the research and development work on the first three Dreamliners. It is also cutting 10,000 jobs this year, or 6 percent of its work force.”

It turned out that there were more problems as the plane caught on fire during its first test flight in 2010. It is now 2011 and Boeing still has not delivered its first 787. Boeing’s outsourcing strategy has therefore cost Boeing workers and Boeing stockholders more than $20 BILLION.

Here are comments from Boeing workers regarding the disastrous outsourcing of the 787:

“Boeing's major problems are arrogance, aloofness, incompetence, lack of integrity among its employees, increasing technical sleaze, lying, misleading, too many incompetent middle managers, horrible absolutely horrible hiring practices, sick corporate MBA culture, almost total lack of ingenuity, cheapness in what matters, mindlessly wasteful, lousy planning and preparation, and treating good engineers like ungrateful children while handing a bonanza to the unqualified. Their sick stifling corporate engineering culture is the last place the problems of a new plane can be solved honestly and accurately because the talent and experience levels are approaching zero. “

“The pinheads in Chicago wanted to cut corners so they could reap more profits. Newsflash geniuses...you get what you pay for. Jimmy M needs to be shown the door and someone with an IQ higher than room temperature needs to be brought in to fix the 787 mess.”

”It just kills me that we pay these people such big bucks to make such stupid decisions!! Back in 2003, when my husband started working on the 787 it was obvious from the get-go that the concept was seriously flawed and wouldn't work and it was not for lack of trying...again and again and again! Boeing gave away the store and now they whine! “

January 2011 Boeing admits 787 outsourcing was a financial failure

In January, 2011, Boeing executives finally admitted publicly that their outsourcing plan cost far more than it would have cost to simply build the planes here in Washington: Boeing Commercial Airplanes chief admitted that this strategy backfired completely — outsourcing cost far more money than it saved, and led to a three year delay in the release of the 787. “We spent a lot more money in trying to recover than we ever would have spent if we’d tried to keep the key technologies closer to home.” Wall Street analysts have estimated that this bad move cost the company between $12 billion and $18 billion dollars, on top of the $5 billion the plane was originally predicted to cost. http://politicalirony.com/2011/02/08/boeing-outsourcing-fail-fooled-twice

2013 November Corrupt Washington Legislature gives Boeing largest state tax break in US history

Despite the fact that corporate tax breaks are unconstitutional in Washington state, and despite the fact that Washington Supreme Court found that the state legislature had violated our State Constitution in failing to fund our public schools, and despite the fact that previous state tax breaks given to Boeing did not create any new jobs – and instead led to massive outsourcing of jobs - in November 2013, Washington Governor Jay Inslee called a special session of the legislature for the sole purpose of granting Boeing another $9 billion in state tax breaks with no strings attached. After giving Boeing the largest tax break in US history, because there were no strings attacked, Boeing continued to lay off another 13,000 jobs between 2014 to 2016. Ironically, at the same time that Boeing was laying off workers, in December 2016, Boeing announced a 30% increase in its quarterly dividend as well as a new $14 billion share repurchase program intended to drive Boeing stock prices even higher.

Transferring the Tax Burden from the Rich to the Middle Class

The point of all of these state and federal tax breaks is to shift the tax burden away from wealthy corporations and onto the backs of working families. As a result, the percent of federal income tax contributions paid by corporations fell from 32% in 1952 to 10% in 2008. This corporate tax rate is about half of the average corporate tax rate in other developed nations. The Treasury Department estimated the federal revenue loss from corporate tax preferences at more than $1.2 trillion over the past ten years.

At the same time, big business politicians raised the amount of income taxes raised through payroll taxes on workers' wages, State taxes and “user fees” on everything from public roads to public parks such that the total tax burden on middle class working families rose from 7% in 1952 to 30% in 2008. See Corporate Tax Reform, Center on Budget and Policy Priorities http://www.cbpp.org/cms/index.cfm?fa=view&id=3411

Currently, the chief executive of Boeing, Dennis Muilenburg is paid $23.4 million per year. Meanwhile, the starting pay for workers at Boeing is a mere $14 per hour.

Bribery as a Business Model

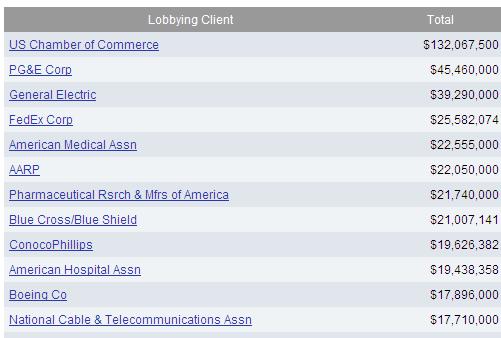

Boeing, like all the major corporations, goes to extraordinary lengths to pay off State and federal politicians in order to maximize its corporate tax breaks. Boeing has an army of lobbyists who swarm the federal and state legislatures to ensure that Boeing’s interests are served. The Center for Responsive Politics lists Boeing as number 11 in its list of the 20 biggest financial donors in American politics in 2010. Boeing spends about $18 million lobbying politicians and providing them with campaign contributions every year. Nearly all of this money went to incumbents in both political parties – recognizing and re-enforcing the principal that incumbents win re-election over 90% of the time. Boeing is an Equal Opportunity corrupter meaning it contributes about equally to incumbents with both political parties. Donations were made to 235 members of the House and 35 members of the Senate.

2010 Federal Lobbying Top Twelve Spenders

http://www.opensecrets.org/lobby/top.php?showYear=2010&indexType=s

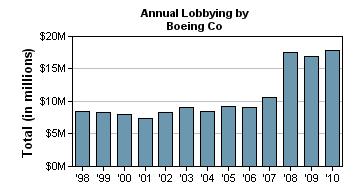

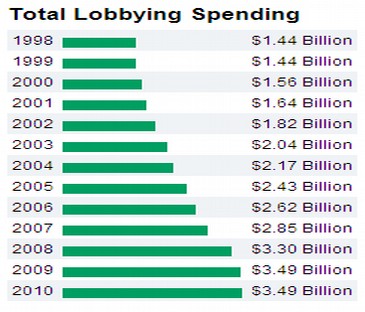

The amount of money Boeing has been spending on lobbying also increased dramatically from 2000 to 2010 - doubling from about $8 billion to $18 billion per year:

http://www.opensecrets.org/lobby/clientsum.php?lname=Boeing+Co&year=2010

This reflects the general trend of all wealthy corporations to bribe Congress:http://www.opensecrets.org/lobby/index.php

Boeing is also a major contributor to Washington State Incumbents. According to the Washington State Public Disclosure Commission, Boeing spent $350,000 in 2010 bribing incumbents in the Washington State legislature. In addition, Boeing donated up to $10,000 each to the House and Senate and State Republican and Democratic Committees – all of which are used to re-elect incumbents. Boeing also donated $75,000 to defeat Initiative 1098 (High Earners Income Tax) and $100,000 to the Initiative to Privatize Workers Comp. http://www.pdc.wa.gov

Boeing works in cooperation with other corporations so that corporate incumbents are often able to outspend non-corporate challengers by a margin of 20 to 1. This is one of the primary reasons that incumbents win re-election over 90% of the time. The other reason is that corporations control the major media – which gives incumbents billions of hidden dollars of media propaganda. For a challenger to win election in a swing Washington State legislative district today costs over $200,000. To win a Congressional District race costs over $1 million.

Boeing's 2010 lobbying expenditure for 2009 was $16.9 million. In December 2011, the non-partisan organization Public Campaign criticized Boeing for spending $52.29 million on lobbying and not paying taxes during 2008–2010, instead getting $178 million in tax rebates, despite making a profit of $9.7 billion, laying off 14,862 workers since 2008, and increasing executive pay by 31% to $41.9 million in 2010 for its top five executives.

https://www.webcitation.org/64D9GyQG0?url=http://www.ibtimes.com/articles/264481/20111209/30-major-u-s-corporations-paid-lobby.htm

Boeing Congressional Payoffs Continue

According to opensecrets.org, in the 2018 election cycle, Boeing spent $32 million on lobbying and 4.5 million in direct campaign contributions for a total of $36.5 million in bribes to federal politicians. The corruption was equally divided by incumbents from both major parties. Most of the bribery was hidden behind political action committees. The gravy was divided between 159 Democrats and 183 Republicans in Congress along with 41 Democrats and 27 Republicans in the Senate. The top recipient was Maria Cantwell D WA with $54 K – not including PAC slush funds. Retired Congressman Norm Dicks WA nickname Mr. Boeing is collecting a cool $50 K per year from Boeing and other $50K per year from General Dynamics and retired Senator Dick Gephart is collecting a cool $60K per year. According to a Daily Beast report, Boeing's lobbyists made $827,000 in political contributions in February 2019. The donations, which were reflected in a recently filed Federal Election Commission report, were the most that Boeing has ever donated in a single month to political campaigns. Boeing and their sub contractors donate more than one million dollars per year to political campaigns. For this, Boeing gets more than three billion dollars per year in state and federal tax breaks.

March 30, 2011 WTO finds Boeing received at least $5 billion annually in illegal State and federal subsidies

http://www.seattlepi.com/business/438020_wto31.html

The US. federal government, states and local governments provided at least $5.3 billion in illegal subsidies to Boeing, a World Trade Organization panel found in a ruling released Thursday.

"Finally the truth emerges: Boeing has received and continues to receive subsidies which have a significantly greater distortive effect than the Reimbursable Loans to Airbus," Rainier Ohler, Airbus' head of Public Affairs and Communications, said in a news release, referring to the main funding mechanism in the earlier case regarding European subsidies to Airbus.

"Taking the cases together, the WTO has now specifically green-lighted the continued use of government loans in Europe and ordered Boeing to end its illegal cash support from US. taxpayers. It's time for Boeing to stop denying or minimizing the massive illegal subsidies it gets."

In the Boeing case, the EU asserted that the US. plane maker got an estimated $19.1 billion in illegal subsidies between 1989 and 2006. This included $10.4 billion in NASA research and development subsidies and the export benefits. In addition to the prohibited export benefits (found to be $2.2 billion to Boeing), the WTO panel found these were improper subsidies: NASA research and development funding, and access to facilities, equipment and employees ($2.6 billion).

November 28 2016 WTO again finds Boeing Tax Breaks are Illegal

https://leehamnews.com/2016/11/28/airbus-boeing-claim-victory-todays-wto-ruling-washington-state-tax-breaks/

“Today’s report from the World Trade Organization (WTO) Panel (DS487) confirms that the United States has ignored international trade rules by permitting illegal subsidies to Boeing, this time targeted at the 777X aircraft,” Airbus said in a press release

Washington’s $8.7bn in tax breaks were specifically tied to the 777X, the WTO found, in violation of its rules, according to Airbus.

March 28 2019 WTO again finds Boeing federal and state tax breaks were violations of WTO trade rules

Final WTO ruling says Boeing’s Washington state tax breaks are illegal. A final ruling from the World Trade Organization (WTO) published Thursday in Geneva left standing its decision from 2017 that the major part of the Washington state tax breaks to Boeing are illegal subsidies. Delivering the final word in a nearly 14-year standoff, the WTO appeal panel didn’t change the previous finding that the state’s Business & Occupation Tax breaks damaged airplane sales by European arch rival Airbus.

A reduced B&O rate was set by the Legislature in 2003 to persuade Boeing to build the 787 Dreamliner in the state. The decision by the WTO’s appellate body considered whether the United States had complied with a 2012 ruling that found Boeing received at least $5 billion in subsidies banned under international trade rules. The WTO ruling found that the Washington state tax break had led to lost sales of Airbus’ A320neo and A320ceo aircraft in five sales campaigns. The WTO’s Appellate Body, effectively the supreme court of world trade, ruled that the business and occupancy (B&O) tax rate reduction in Washington state had significantly cut Airbus sales in five particularly price-sensitive sales campaigns.

By the end of 2010, Boeing workers had been subjected to wave after wave of layoffs due to outsourcing schemes that cost Boeing billions of dollars. Boeing leaders had committed countless crimes using bribery and blackmail to obtain billions of dollars in illegal tax breaks from Washington state and the US government. These billions in tax breaks were literally robbing one million school children in Washington state of an education. Yet none of these crimes could compare to what was about to come next – the Boeing decision to create the 737 Max.

2011 to 2019 Greed Finally Catches Up to Boeing

On December 1 2010, Airbus announced the A320 Neo a more fuel efficient single aisle plane at a time of increasing jet fuel costs. The neo sold very well in its first few months. On July 20, 2011, a major Boeing customer, American Airlines announced the purchase of 460 planes. 260 would be Airbus and only 200 Boeing.

Even with this, the 200 Boeing planes were required to have more fuel efficient engines – even though there was no more room under the wings of the 737 NG.

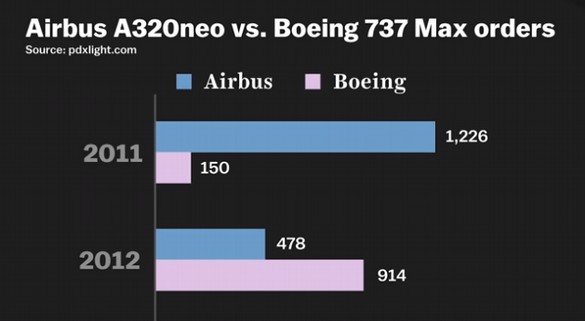

This was the beginning of the 737 Max. The Boeing promise to build a 737 with a bigger engine even though it was technically impossible worked – at least in terms of generating orders. While the Airbus A320 NEO dominated orders in 2011, the Boeing 737 Max dominated orders in 2012:

The celebration at Boeing was short lived as since 2012, the A320 NEO has become more popular that the 737 MAX:

| Orders |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

| 737 MAX |

708 |

891 |

409 |

530 |

759 |

720 |

| 320 NEO |

873 |

1009 |

887 |

711 |

925 |

562 |

https://en.wikipedia.org/wiki/List_of_Airbus_A320neo_family_orders_and_deliveries

Airbus has also been able to deliver twice as many planes as Boeing:

| Deliveries |

2016 |

2017 |

2018 |

2019 |

Total |

| 737 MAX |

0 |

74 |

256 |

46 |

376 |

| 320 NEO |

68 |

181 |

386 |

143 |

778 |

60 A320 NEOs are made every day in four plants around the world (France, Germany, China and Alabama). Meanwhile, currently 42 737 Max planes are made every month in Boeing’s Renton factory

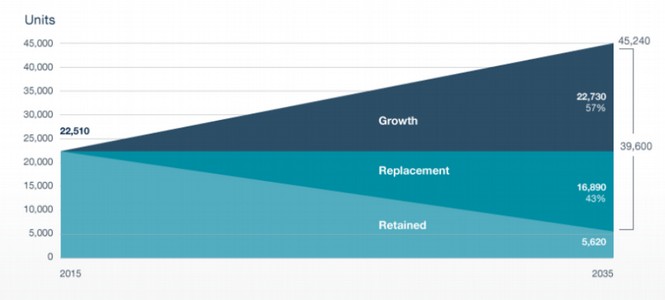

This presentation indicates there will be a need for 40,000 new commercial airplanes in the next 20 years (2,000 per year)

https://alacpa.org/pdfs/2016-DIA%201%20PDF/5-Yonglian-ALACPA%20Presentation%2029%20Nov%202016.pdf

The total orders for Max and Neo planes over the next 10 years is more than 20,000 planes worth more than two trillion dollars. Before the design problems were exposed, it was expected that Boeing would get half of this market or one trillion dollars. However, once another Boeing 737 Max crashes, it will likely get nothing and the entire market will go to Airbus.

The first Max delivery was May 6, 2017. The first Boeing 737 Max crash occurred on October 29, 2018. The second Max crash occurred on March 10, 2019 – less than 2 years after the Max was first delivered – for an average of one Max crash every year. In the next section, we will estimate how long it will take before Boeing is out of business.